Hits: 86

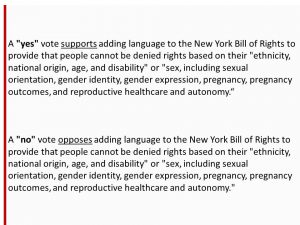

May Median Single-Family Home Sales Prices Rose by Double Digits in Almost All Regions;

Closed Sales Declined in Every Area Except Westchester

New Listings Grew in Rockland, Orange, and Sullivan Counties

WPCNR REALTY REALITY. From the Hudson Gateway Association of Realtors. June 25, 2024:

Median sales prices for single-family homes saw double-digit increases in every county, with the exception of the Bronx, which experienced a slight drop of just 1.6%.

Westchester County reached a new high, with a median of $980,000 – a 16.3% increase over last year’s median home prices.

inside Westchester County

For the first time in months, sales of single-family homes increased slightly by 4.6%, and the median sales price advanced by 16.3% to a new high of $980,000. Last year at this time, the median price held at $842,500 and just last month it stood at $870,107.

The County’s condo market also experienced a boost of in sales at 16.5% and a 9.8% hike in the median sales price to $499,500.

Closed sales declined by 4.8% in the co-op market, however the median sales price grew by 10.1% to $205,000.

Drooping inventory: New listings for condos rose by 26.3% but declined by 15.8% for co-ops and 10% for single-family homes. Overall inventory for all property types declined, with co-ops seeing the largest decrease at 33.3%, followed by single-family homes at 21.3%. Months of supply was down 10.7% to just 2.5 months, and pending sales fell by 11.1%.

Closed sales in the condo markets for both the Bronx and Westchester rose by 18.8% and 16.5%, respectively.

Westchester’s condo and co-op median prices also increased by about 10%.

In Rockland County, the median condo price jumped 49.2% to $472,000, the Bronx median condo price grew 42% to $350,000.

Inventory plummeted in all areas except Sullivan County, which experienced a 5.8% increase. The Bronx scored the highest for overall pending sales for all property types with an 18.4% hike. Most of the other areas reported a decline in pending sales.

Today’s report by the Hudson Gateway Association of Realtors (HGAR), based on data supplied by OneKey® MLS, reflects varying performance for inventory, with Westchester, Putnam and the Bronx declining, while Rockland, Orange and Sullivan new listings were on the rise.

“Due to strong demand and limited supply, home prices are continuing to rise in our area, ensuring the value of owning property and wealth creation for homeowners in the lower Hudson Valley,” said Lynda Fernandez, HGAR CEO. “New listings are increasing in half of our region, pointing to more homes coming onto the market, while rising pending sales signal an increase in future closed sales.”

Bronx County

Single-family home sales decreased slightly by 4.3% and the median sales price also dipped slightly by 1.6% to $610,000. Last month, the median was $617,500, and last year at this time, it was $620,000. Condo sales, however, rose by 18.8%, and prices by 42% with a new median of $350,000. This tops last month’s median of $285,000 and last year’s median of $246,500. However, sales in the co-op market saw a 6.8% decline and a 4.9% decrease in median sales price to $215,000. Last May’s median co-op sales price held steady at $226,000.

New Bronx listings for both condos and co-ops climbed by 26.7% and 15.7% respectively, while listings for single-family homes dropped by 15%. Overall inventory for all three housing types was down significantly, with condos seeing the largest decline at 36.8%. There were 34% fewer single-family homes on the market, and 15.9% fewer co-ops. As of May there were six months of supply, down by 21.1% from last month. Overall pending sales for all property types were down by 12.8%.

Single-family home sales in Putnam County saw a decrease of 29.2% in May but condo sales rose by 62.5%. The median sales prices for single-family homes increased 13.5% to $565,000 – up from $498,000 in May of 2023. Condos also saw a hike in the median sales price by 6.9% to $369,000. No co-op sales were reported in May.

While Putnam typically has a very limited supply of condos, new listings for condos saw a 650% increase, to 15 condos, up from just two last May. Single-family home listings declined by 14%. Inventory for condos also rose significantly by 150% from six to 15. Months of supply for both property types was up by 3.7%, leaving just 2.8 months. Pending sales declined by 6.3%.

Rockland County

Rockland’s co-op market, while small, saw the largest drop in closed sales from last year, by 81.8%. This time last May there were 11 closed co-op sales, as opposed to just two this year. Closed sales for condos also declined by 28.9%, and 10.4% for single-family homes. Again, co-ops were the big winners when it came to price increases – the market realized a 158.4% gain on median sales prices to $307,500, up from just $119,000 in May of 2023 and $140,000 from last month. Condos saw a 49.2% increase in median sales prices to $472,500, as compared to $316,750 last year. Single-family homes experienced a 19.5% growth in median sales prices to $776,000.

New listings for condos grew by 24.5%, and 4.9% for single-family homes. Co-op listings, however, dropped by 18.2%. Inventory for all three property types declined , with co-ops seeing the largest drop at 50%. Months of supply for all property types was down 10.3% to 2.6 months, while pending sales were up by 13%.

Orange County

In Orange County, sales of single-family homes declined by 13.2% and condos by 20%. However, condos saw a 21.4% increase in the median sales price to $312,50 – up from $257,500 last year. Single-family homes also got a boost in the median sales price to $442,500, which is 2.9% higher than last year. There was just one co-op sale in May at $140,000, as co-ops properties are limited in Orange County.

New listings for condos rose by 13% and 6% for single-family homes. Inventory dropped by 30.2% for condos and 15.2% for single-family residences. Months of supply increased 3% in May to 3.4 months, but pending sales declined by 7.4%.

Sullivan County

While Sullivan County’s single-family home sales declined 12.9% in May, the median sales price grew 27.5% to $347,500, over last year’s median of $272,500. There was just one condo sale at $230,000 and no co-op sales during the month.

New listings for single-family homes advanced by 16.7% and inventory increased by 5.8%. As of May, Sullivan had the largest months of supply at 6.4 months, an increase of 20.8% over last month., Pending sales of single-family homes also increased at a rate of 8.8%.