Hits: 29

WPCNR REALTY REALITY. From the Hudson Gateway Association of Realtors. (Edited) October 5, 2020:

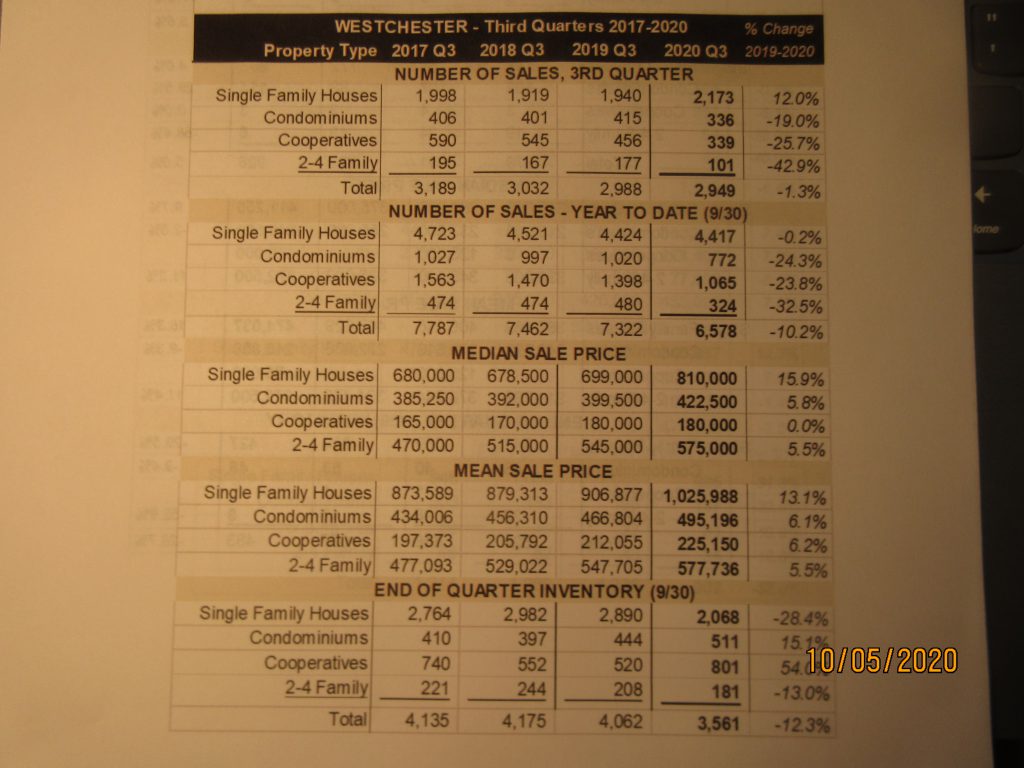

Weschester County saw single family residential sales increase 12% in July-August-September over 2019

A sharp drop in condo, co-op and multi-family (2-4 family homes) caused an overall decline in total Westchester residential sales of 1.3%, to 2,949 units from 2,988 in the third quarter of 2019. The market is being driven by demand for single family homes.

The median price of single family homes were up in all counties in the region: Bronx County, Sullivan County, Putnam, Rockland and Orange counties. The Westchester County single home median price rose 15.9% to $810,000 from $699,000 in the third quarter of 2019. The average price of a single home sale in the third quarter was $551,353—down 1.8% The difference in the median and the average price indicates how higher priced luxury homes dominated sales.

Westchester Co-op Sales previously a leader last year, were down 25.7%, however the co-op price did not drop rising to $237,500 median price (up 8%), and average price of $277,883 (up 14.7%)

Westchester Condo sales continued down, while condo prices continued to trend up. The average Westchester Condominium sale was $363,672, up 18.3%, the median condo tag was $312,500 an increase of 11.6%, indicating lower price condominiums are retaining attractiveness to the house entry market.

HGAR analysts point out that multi-family sales were down across the board, specularting that decreases in condo sales (down 19.7%) and multi-family (dropping 24.8%), and Co-ops (off 32.2%) were “more of a function of Covid-19 related issues than lack of buyers and/or interest.”

HGAR laments “Lack of inventory continues to hamper sales in all residential categories,” but notes “Recently listing activity has increased as buyers become more comfortable with the measures put in place to protect them from exposure to the Covid virus as well as the vibrancy of the market.”

Commenting on the housing market HGAR observes,

“It is difficult to predict market conditions going forward. In the short term the market remains strong with the number of properties in contract exceptionally high at this point of the year. These contracts should represent closed sales before the year’s end. Interest rates remain at historic lows, which contributes to affordability. Migration to the suburbs has created huge demand. What is difficult to evaluate is how long a complete recovery will take and how that will impact the market going forward.