Hits: 834

WPCNR REALTY REALITY. From the Hudson Gateway Realtors Association. (Edited) January 4, 2021:

Residential sales in 2021 in the counties served by OneKey MLS, Inc. reached a historic peak.

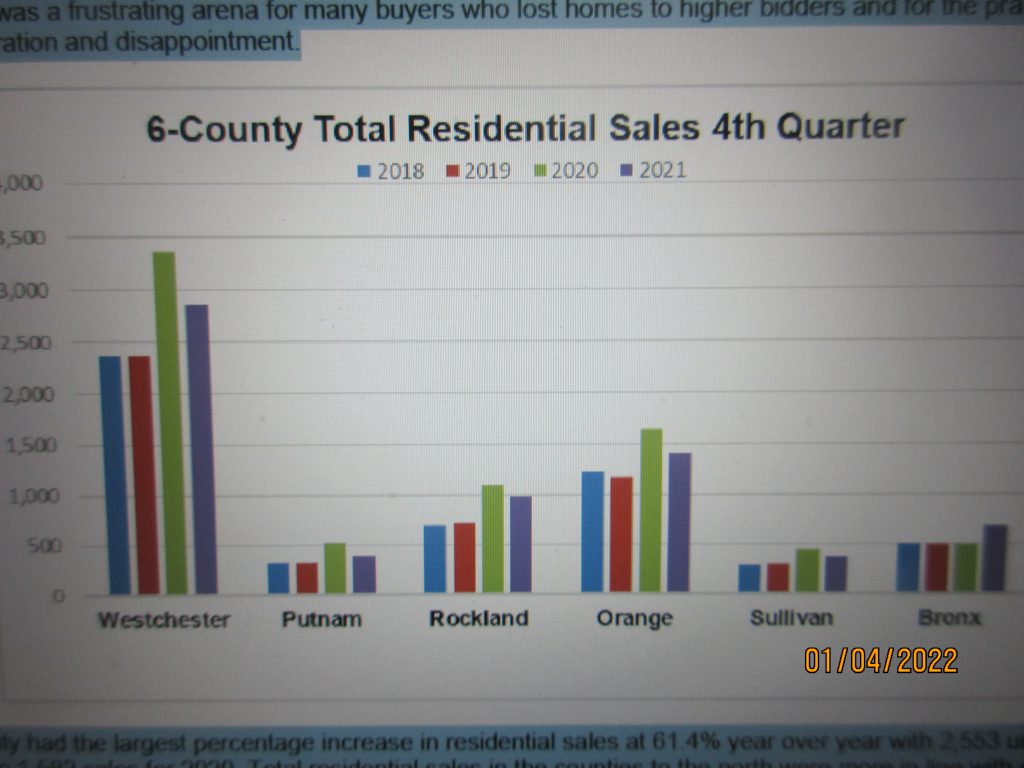

Sales slowed in the fourth quarter in all areas served by OneKey MLS except for Bronx County. Arguably, some of the slowdown can be attributed to the dearth of inventory in the counties north of NYC.

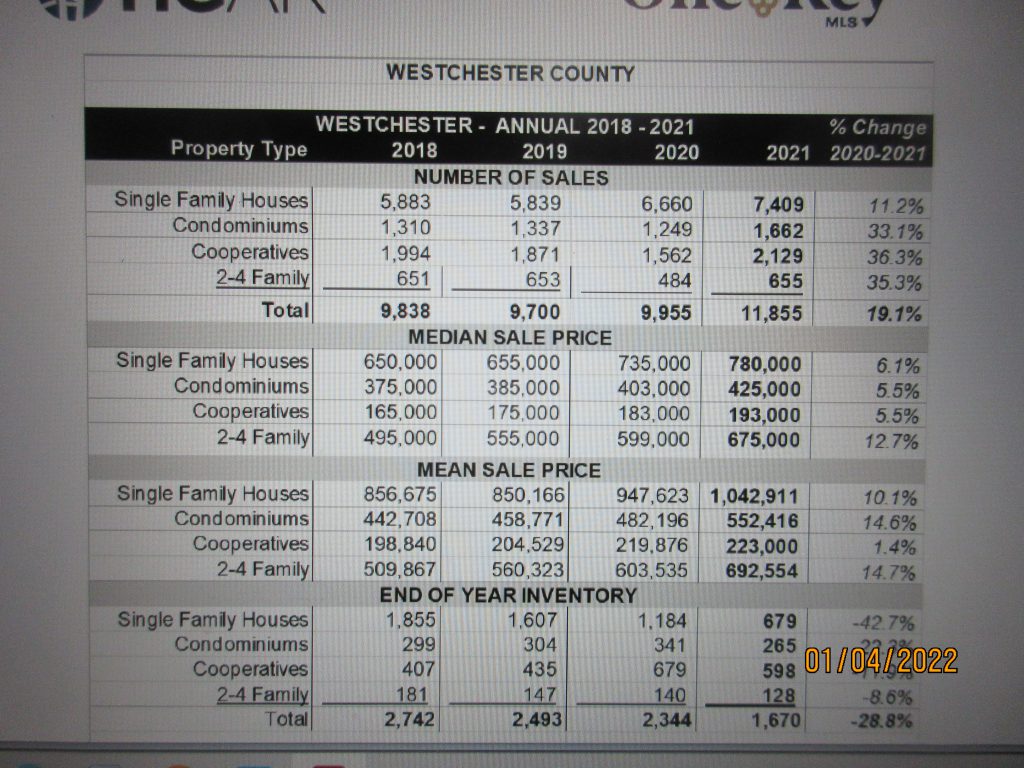

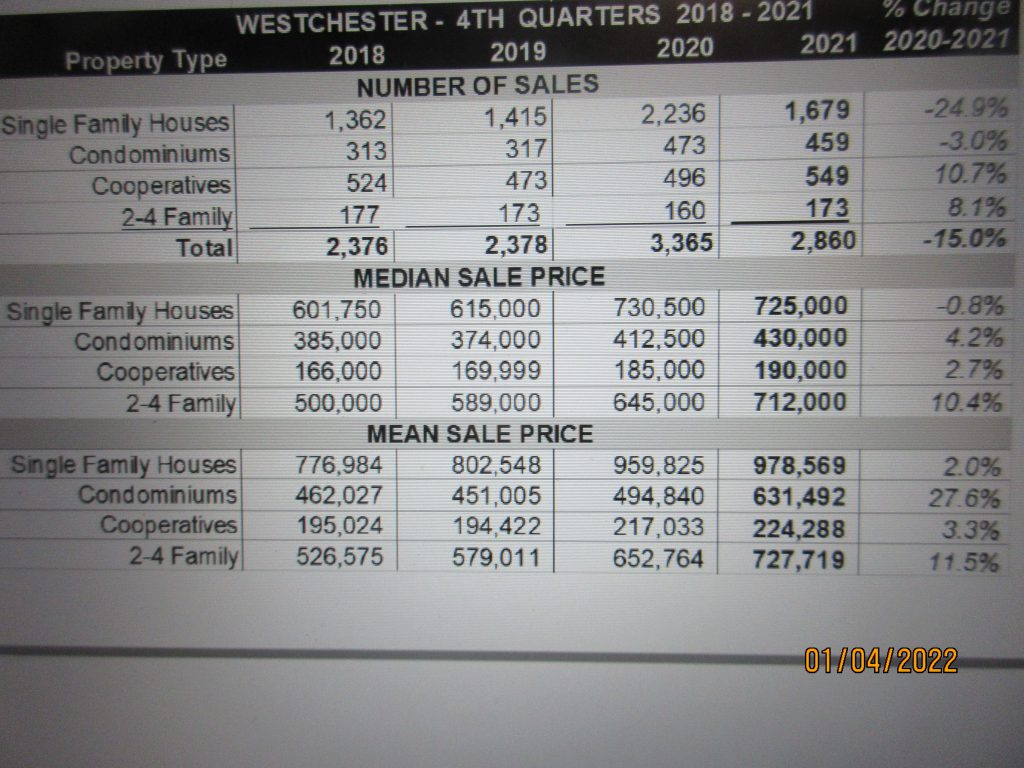

Westchester County, with the highest prices in the region, had the smallest percentage increase in median price for the year at 6.1% ($780,000 as compared to $735,000 in 2020) and actually experienced a slight decrease (-0.8%) in median price for the fourth quarter. This may be indicative of price increases beginning to moderate.

Condominium, multi-family (2-4 family), and in Westchester County, co-op sales as well, all outpaced the increases in single-family units and, in most instances, percent of median price increase.

In Westchester County, where co-op sales lagged in 2020, they increased 36.3% to 2,129 units (from 1,562 in 2020).

Affordability is the most prevalent reason for these choices particularly in view of the price increases in single-family dwellings. For many suburban purchasers, condos and co-ops represent a means to build equity to purchase a single-family residence

The breakthrough in The Bronx demonstrates return of buyers to the New York City market.

While the view of the market in terms of units sold and dollar volume is a positive one, it was a frustrating arena for many buyers who lost homes to higher bidders and for realtors dealing with client frustration and disappointment.

Indicators such as days on market were down significantly in all market areas. Homes were selling close to or at list price and above list price as a relatively common event.

Lack of inventory continues to be a problem with no meaningful resolution on the near horizon. With the Fed tightening monetary policy it is expected that mortgage rates will begin a steady rise in 2022.

However, despite these headwinds, the real estate market in the New York City and greater suburban area, including the lower Hudson River Valley, have shown remarkable resiliency in the last year and a half, and we expect a strong real estate market to continue into 2022.

With the exception of the second quarter of 2020, the real estate market has been an anomaly outperforming the economy. Sales and prices have enjoyed a trajectory which is likely unsustainable going forward, however the economy of the Hudson Valley continues to improve and grow more vibrant which bodes well for real estate. It is likely that price increases will moderate and additional product will come on the market which will sustain a strong market in the near term.