Hits: 23

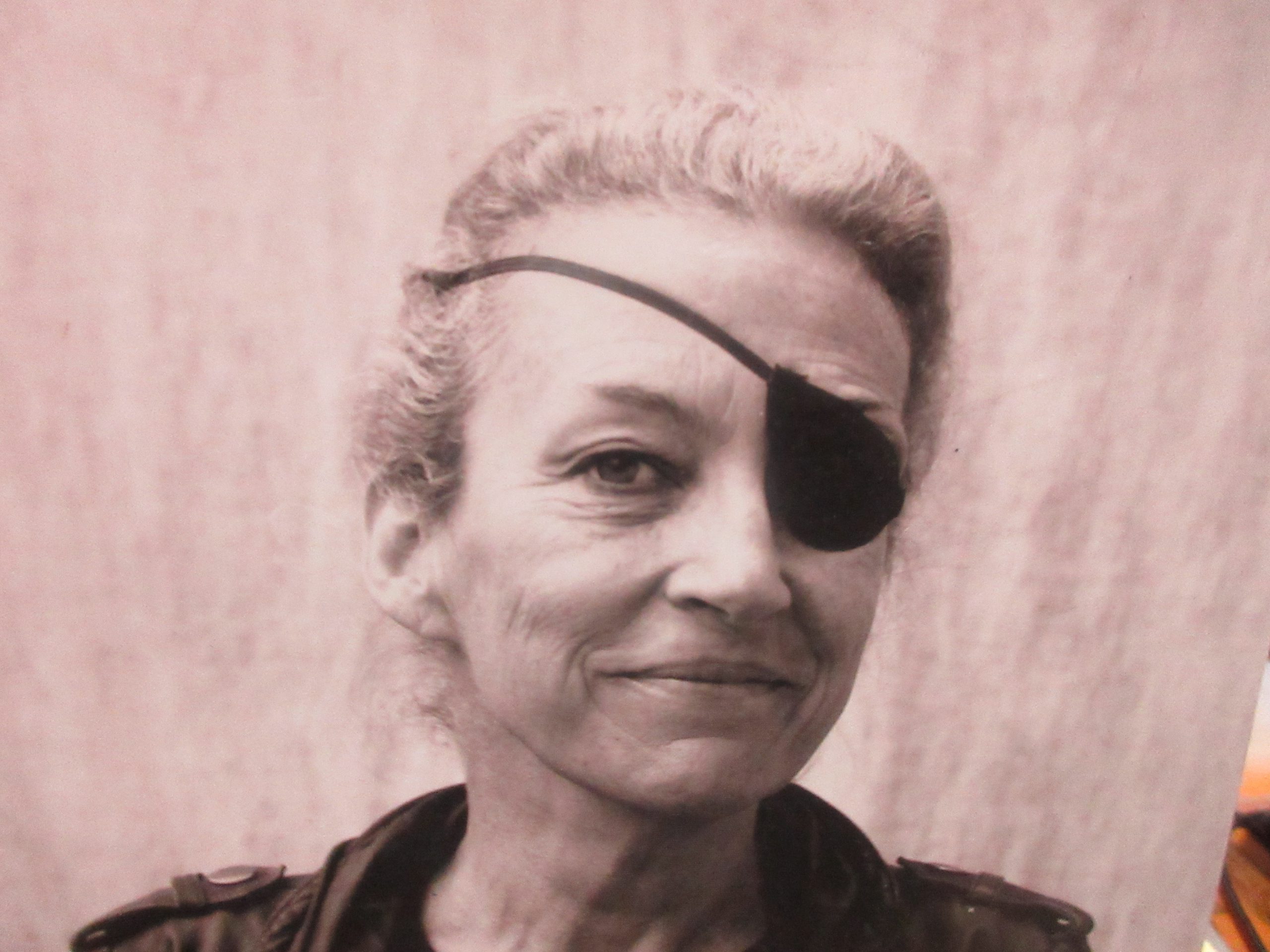

WPCNR QUILL & EYESHADE, By John F. Bailey. November 13, 2014:

Lloyd Tasch, White Plains City Assessor announced this afternoon the city is extending its Tax Status Deadline for veterans from December 1 to December 12 to assure White Plains residents who are military veterans will be able to file and receive the new Veterans exemptions approved by the White Plains Board of Education Monday evening

Tasch told all veterans currently received the basic veterans exemption will be automatically upgraded to whatever new exemption: 15% Basic Exemption, 10% Combat Exemption and 50% of their Disability Rating, based on their state provided records and will be sent a new Veterans Exemption application which must be returned by December 12.

The new veterans tax exemptions have been on the books for 11 months ago. The exemptions were passed and signed by the state legislature and Governor Andrew Cuomo December 18, 2013. Mr. Tasch had informed the school district of the availability of the new exemptions at the time of the bill’s passage.

The Board of Education did not approve the exemptions until last Monday evening, leaving just 13 days for the City Assessor’s Office to process veterans requests.

The Assessors office was not informed of the School District intention to pass the exemption until the assessor, Lloyd Tasch learned of the Board of Education passing the exemptions on this website Tuesday morning.

Tasch issued this statement to WPCNR Thursday afternoon on how veterans can claim the exemptions.

“I just received the Official email (reporting the school board passing the exemptions) from Mr Seiler. (Assistant Superintendent for Business for the School District)

1 I am mailing out tomorrow an Alternative Veterans Application to all Eligible fund veterans.”

Mr.Tasch told WPCNR today that veteran homeowners, (with the exception of co-op owners whose eligibility for the exemptions is not clear at this time) who have served in the last 25 years in the two Iraq wars, the Afghanistan conflict,or service during that time and who may be eligible for the new Basic Exemption of 15%, the 10% Combat Exemption and the new Disability Exemption of 50% of the veteran’s disability rating need to apply for those exemptions by filling out the Alternative Veterans Application.

His statement continued:

“I am allowing these exemptions only to be filed by December 12, 2014.

“Any veteran currently receiving the Alternative Veterans Exemption will automatically be given the additional appropriate level of school tax exemption for the new Combat Exemption, and Disability.”

2 No (other) documentation is necessary other than the

Alternative Veterans Exemption application.

3 It (the new Veterans Exemptions) will be implemented for 2015/16″

Tasch said his office is ready to answer any questions those receiving the Alternative Veterans Exemption Application. It will be accompanied by a cover letter (just created).

He said about 400 veterans in White Plains are already receiving the Basic Exemption, but as many as 200 more may be eligible to be receiving the new combat and disability exemptions. Tasch said the Assessor Office is able to upgrade with all three new exemptions: the Basic, Combat, and Disability categories because they have that information on current veterans’ records which are furnished by New York State.

He said veterans of Korea, World War II and Vietnam have to apply for the new exemptions. Cold War veterans are not affected.

The number of the Assessors Office for any questions is 422-1223

Tasch said the Assessor’s office has already arranged for their computer programmer to reprogram the Assessor files to implement the new exemptions.

” I have great respect for veterans and I will do everything possible to accommodate all veterans and make sure they receive the new exemptions they are entitled to receive.”