Hits: 113

REAL ECONOMIC GROWTH IS ONLY 3%.

WHITE PLAINS UP 8% ON TARGET FOR $54.7 MILLION BY JUNE, A RECORD.

WPCNR QUILL & EYESHADE By John F. Bailey November 29, 2022 UPDATED:

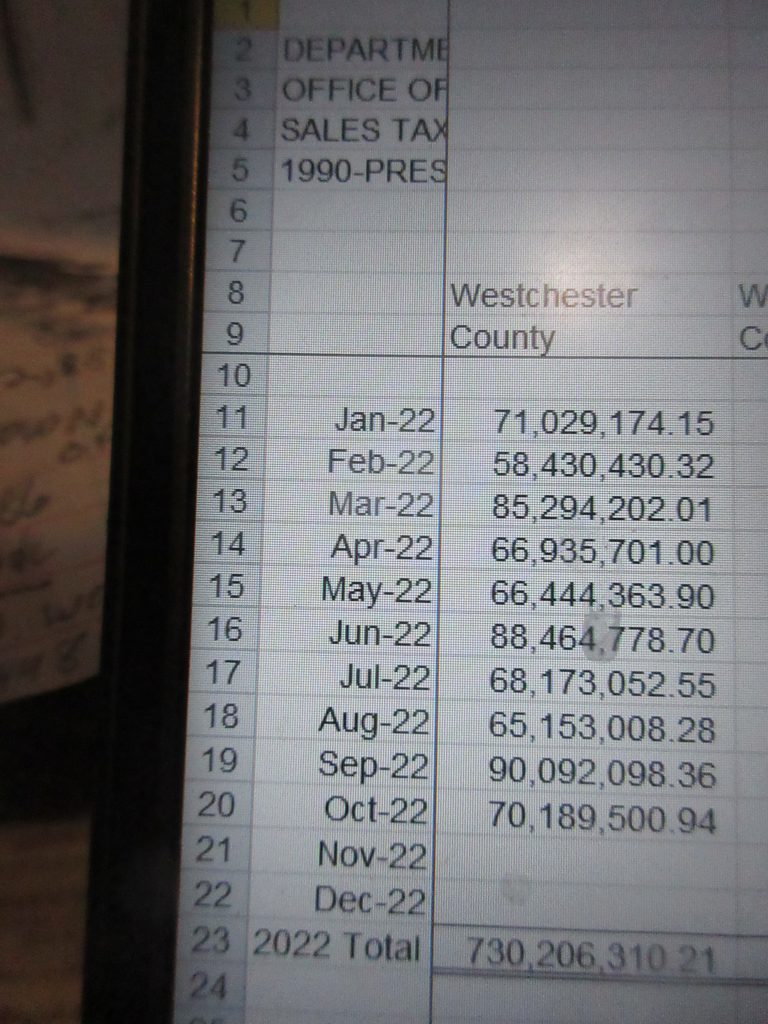

Westchester Sales Tax collections have grown 11% over 2021, fueled by the extradordinary 8% inflation. Real growth of the Westchester economy is roughly only 3%.

Westchester, through October, according to the New York State Department of Taxation & Finance, has collected $703,206,310 in sales tax receipts through October 11% more than the $657,124,249 the county collected through the first 10 months of 2021.

The county, IF they collect the same revenues from sales taxes they received last October and December, $61,536, 612 and $94,640, 895, the county will gross $886,383,917 for the year.

The County, if county resident consumers spend at the current 11% growth rate in sales tax dollars in November and December will earn $17.1 million more putting them over $900 MILLION ($903,563,342).

In order to reach the $909,850,000 million in sales taxes budgeted for 2023 by the county financial experts, the county would have to have a 15% increase in the November December two months in order to reach the $910 Million. It is possible.

In 2021 the December sales tax went up to $94,640,995 million over $83,763,988 in December of 2021, an increase of 13% in one month one year over the other.

If the county does continue steady in its present growth it may fall short again as it did 6 years ago.

Optimism without reason has got the county into trouble in the last two years of the Robert Astorino administration. Projecting continued growth in the county economy based on an inflation-created revenue surge is going 90 miles an hour down a Dead End street and the brakes are gone (Thank you Hank Snow).

Thanks to covid, the county has had its deficit erased by millions in covid aid which they used to pay off their deficit caused by overoptimistic budgeting 6 years ago, and use the rest of it to replenish their fund balance, which actually should have gone to victims of covid.

Now, this record sales tax year is being looked on as a perpetual phenomenon. Is the county again betting with chips they do not have?

Maybe. Or as an sportscaster friend of mine Steve Gilmartin of WMAL TV once said after the Washington Senators went 18-10 in their first 28 games, “We were living in a fool’s paradise, my friend.”

This 11%, figure watchers, is not real growth. It is created by inflation in prices. Consumers cut back. The consumer has fixed income. So when higher prices bring in increased revenue companies and governments gain, but the growth is not real.

It just looks like the economy is growing and happy days are just around the corner.

But the growth is not real.

One trip to the supermarket will tell you that.

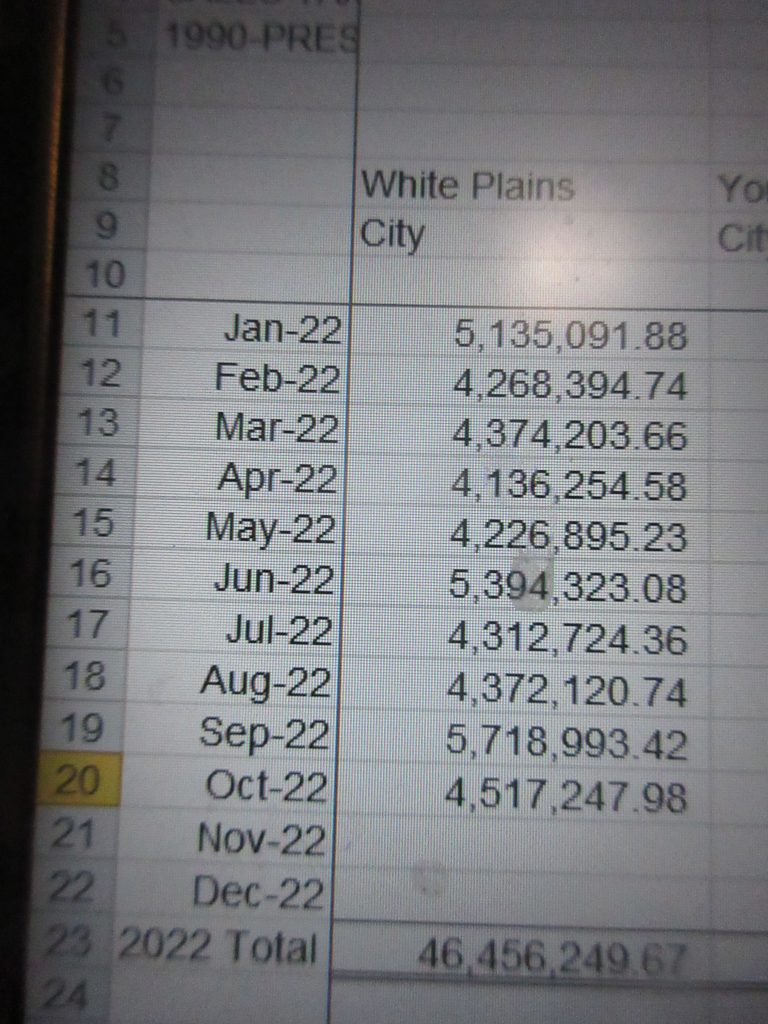

How’s White Plains doin’? Steady and Stable. 8% growth Not betting chips they do not have.

The City of White Plains is UP 8% after the first 4 months of its fiscal year with $18,921,084 in sales tax revenues. If we match last year November December figures, we are sitting on $25,164,856 in revenues for the first 6 months.

If the city economy matches last the first six months of 2022 (when the city gained $27,335,160 in sales tax revenues), the City of White Plains will post $52.5 million in sales tax receipts a sales tax record. White Plains should benefit from some inflation in those months, too. IF the first six months continue at 8% growth, the city will gain an additional $2,186, 812 dollars creating a final figure of $54,686,828.