Hits: 97

INFLATION IMPACTS CITY SUPPLIES IN NEW YEAR. EXPECTS CONTINUED RECOVERY IN SALES TAX $$, PARKING $$ RED LIGHT $$ FINES. NO CUT IN SERVICES. NO REPLACEMENT OF PERSONNEL WHO LEAVE. 3 NEW POLICE, 2 NEW FIRE HIRES.

WPCNR COMMON COUNCIL CHRONICLE EXAMINER . By John F. Bailey. April 5, 20222:

The City of White Plains submitted a proposed $210.3 MILLION 2022-23 City Budget to the Common Council last night at City Hall, an increase of $6 Million from from $203.proposing a 1.86% increase in property tax to $234.51 of assessed value.

In a media briefing, Commissioner of Finance Sergio Sensi and Budget Directtor James Abbott said the tax increase is needed to cover half the expected impact of 3.8% inflationary pressures on gasoline, supplies, and uniforms anticipated by city departments affecting the city expenses as it also does the general public, and to meet contract obligations and required benefits expenses while anticipating growth in city sales tax receipts to produce up to $50 million (perhaps more) in sales tax revenues.

The impact on the property owner of a median priced home of the 1.86% tax increase, assessed at $13,000 would be $58 more annually.

To figure your new city tax multiply your this year total city tax by .0186 to get your new total city tax.

(Editor’s Note:)Your White Plains City school tax will remain the same because the school district is not raising their tax rate.

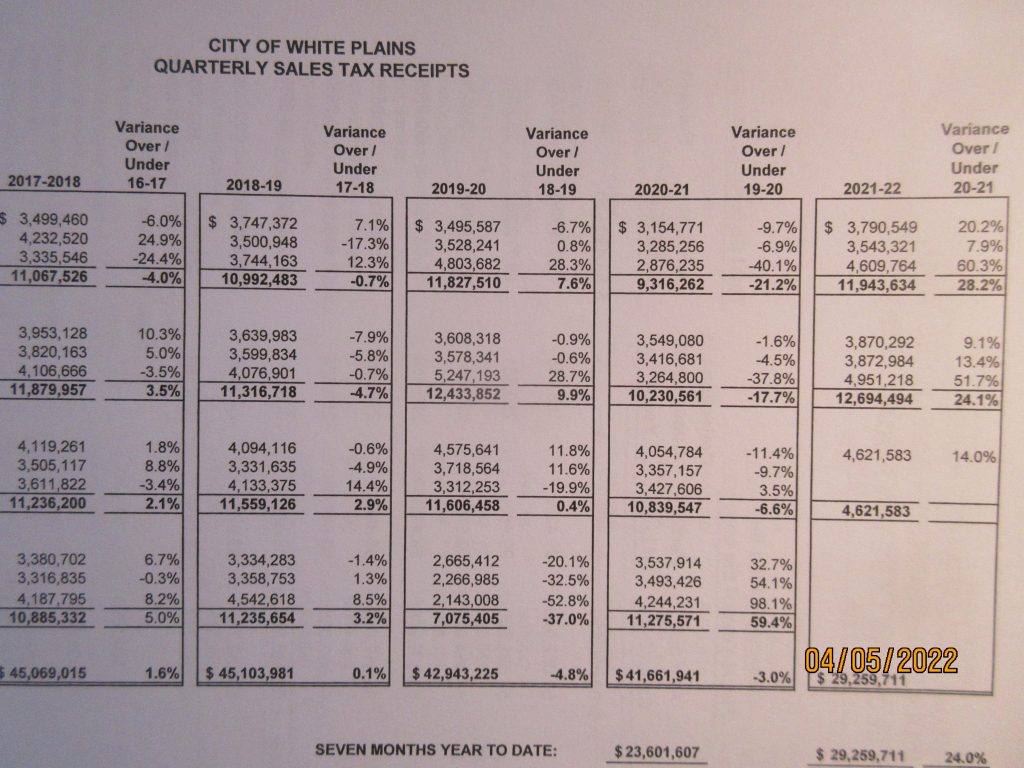

Total sales taxes are expected to hit approximately $48 million perhaps over $50 Million. The present pace would bring back the city sales tax component to the $48 Million of 2019-2020 compared to the $41.7 Million collected in 2020-21 a decline in 20-21 of 3%.

City budget crafters James Abbott, Budget Director and Sergio Sensi explained the budget in a media brief placing the loss of city revenue due to covid in 2021-22 after reimbursement at $23 Million

Mr. Sensi and Mr. Abbott explained to WPCNR the city had been reimbursed $23 Million in American Rescue Plan covid relief. This payment accounted for the loss encountered through only the first 9 months of the year 2020-21). The city was not allowed to resubmit for more reimbursement at the end of the year, and no documentation was required by the government from the city for the first and only submission. The city received half the amount of $23 million in 2020-21 and the other $11.6 Million in 2021-22.

Hardest hit of city revenues was the sales tax receipts, down to $41.7 Million this fiscal year. The city budget message said the sales tax handle has “increased significantly” in part due to collection of internet sales taxes that rose “significantly” in 2019-20, but it is too soon to tell whether the increase so far in 21-22 will continue.

Parking and fines revenues were also impacted during the last year. The budget message anticipates

“parking related revenues of $25.6 million, including meter fees,parking related fines,red light fines and permit charges…parking revnues have only recently bounced back. Actual parking revenue in 2018-19 was $26.8 million or 22% more than budgeted in 2021-22. As more and more people are beginning to come back to the city to work and shop, these revenues have increased and the current year forecast is again nearing those pre-pandemic levels and is projected to be $25.8 million.

All city services are being maintained at current levels. Positions that are vacated will not be replaced but positions continue to be budgeted. The city also anticipates $695,000 in new revenue from eight city-owned facilities now with solar panels on the roofs.

The city has an undesignated fund balance of $21 Million.

The increase in the 204.3 Million budget last year is 6%.

It is under the 2% tax cap for the 11th consecutive year.

Assessment Roll grows to$286.1 million, up $1.8 Million