Hits: 37

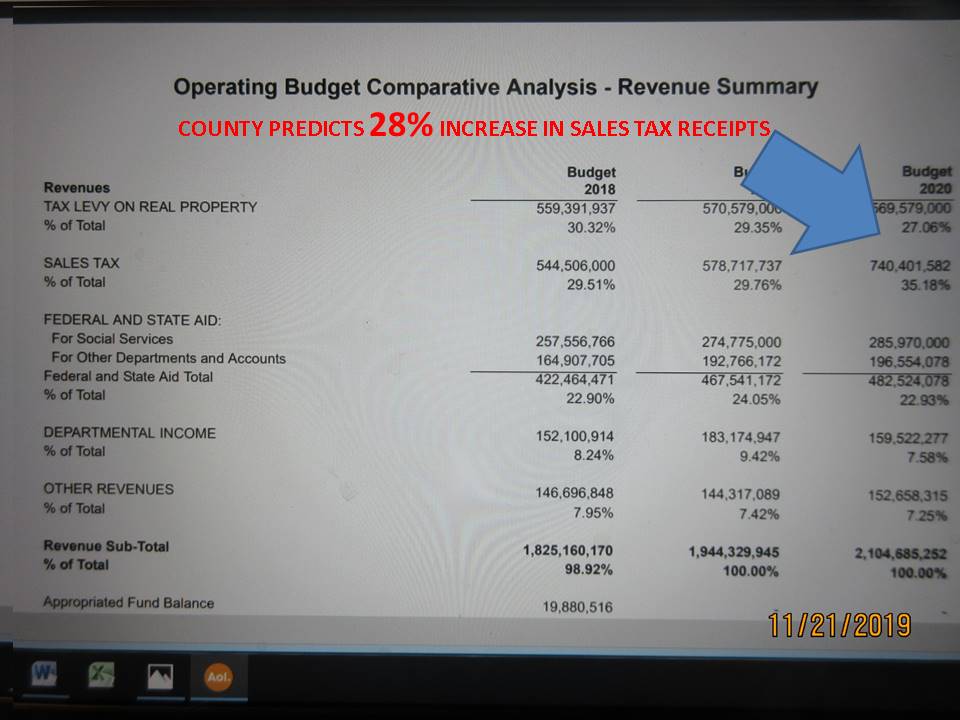

PROPOSED 2020 COUNTY BUDGET BANKS ON WESTCHESTER SALES TRIPLING IN ONE YEAR

BALANCES BUDGET PREDICTING 27.9% INCREASE IN SALES TAX DOLLARS on a 1% SALES TAX INCREASE.

WPCNR QUILL & EYESHADE. NEWS & COMMENT By John F. Bailey. December 1, 2019 UPDATED 3:45 PM EST:

Jake Barns, the Foreign Correspondent in Ernest Hemingway’s The Sun Also Rises, has the perfect analysis of the 2020 Westchester County Budget they take up this month.

Lady Brett Ashley, the woman Jake loves, tells him in a taxi on the way to the airport in Madrid at the close of the book,

“We could have had a damn good time together.”

A policeman holds a baton ahead forcing the taxi to swerve, throwing Brett against him, reviving a dream that might have been.

Jake staring at the beautiful Brett answers with one of the great last lines of all time:

“Isn’t it pretty to think so?”

Heads up, Board of Legislators.

You now have in your hands a PROPOSED 2020 Westchester County budget touted as a plan that lowers county property taxes, rebuilds the fund balance, has settled labor peace, raises your salaries by 50%, and establishes plans to build affordable housing. It is a wonderful thing.

The new budget is a pipe dream built on a revenue structure based on the prediction that the Westchester sales tax revenue and economy will grow by 27.9% in 12 months.

The greatest economy in the world, the U.S. GNP only grows 4 to 5% in its best years. So Westchester’s economy is growing 28%? I think the legislators taking up this budget have to demand how this happens? What are the trends saying this will happen?

Put another way, how can you predict a 27.9% increase where the county has ONLY HAD ONE SUCH phenominal increase in Sales Tax Dollars year to year– 33% in 1992—and that was 26 years ago.

The largest increase since 1992 was 16% in 2004 ($398.1 MILLION COMPARED TO $342 MILLION in 2003)

Sales Tax Revenues Performance of Westchester County 2008-2019

2008 $462,898,900, 0%

2009 $415,113,254 -10%

2010 $441,845,931 + 6.4%

2011 $450,885,825 +2%

2012 $459,596,102 +2%

2013 $488,045,564 +6.2%

2014 $503,802,272 +3.2%

2015 $499,527,981 -1%

2016 $505,878,099 +1.2%

2017 $525,513,104 +3.8%

2018 $550,562,481 +4.8%

2019—through 3 Quarters–$438,405,917

Projected in 2019 4th Quarter, based on meeting 2018 4th Quarter

TOTAL 2019 $581,819,193 UP 5.7% (includes 1% sales tax increase)

If the county exceeds last year’s October, November, Dec. sales tax receipts, the increase in 2020 in sales tax revenues could be more. But it is hard to see where the 27.9% increase in sales tax receipts is achievable based on the past results the last 10 years, or the last 26 years results.

WPCNR made two requests to the Westchester County Department of Communications last Monday for an official explanation of why the county expects a 27.9% in sales tax revenues in 2020. To date there has been no response.

27.9% of $582 Million is $157.1 MILLION. Add that to 582 Million and you get $739 million the projected figure of sales tax revenues in the County’s 2020 budget.

But that contains the assumption the county economy or sales tax activity will triple next year.

It has only tripled once in a year in 26 years. Unless of course the state has guaranteed the county this money out of next year’s sales tax receipts.

Editor’s Note: The 1992 sales tax revenues increased 33%. It was inflated by County Executive Andrew P. O’Rourke transferring $14.2 Million of the January 1993 sales tax receipts into the 1992 budget, to avoid a deficit that would have caused a 4.3% property tax increase. You can read about this at

https://www.nytimes.com/1991/12/15/nyregion/budget-gap-is-closed-by-sales-tax-advance.html

With the transfer of the January sales tax dollars of January 1993 into the 1992 budget the increase in sales taxes would only be a 24% increase in 1992, so technically the 27.9% increase contemplated in the 2020 budget is the largest increase in sales tax dollars projected in 26 years.

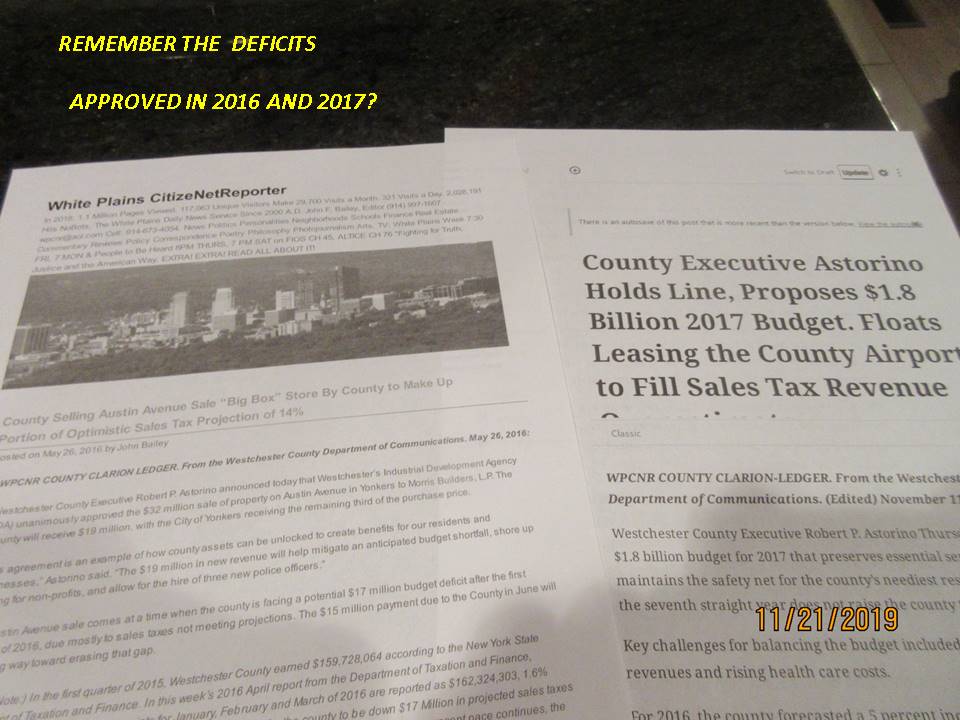

When the Astorino administration predicted a 15% sales tax receipts increase in 2016 in crafting the 2017 budget , they only got a 4% increase. Democrats approved that budget for 2017, then criticized Astorino for creating deficits. You read about the 2017 budget here at

You can read about the 2016 Budget problem here:

County Executive Astorino Holds Line, Proposes $1.8 Billion 2017 Budget. Floats Leasing the County Airport to Fill Sales Tax Revenue Overestimate.

In 2017, the same thing happened. Astorino attempted to balance the budget in 2018 with leasing the airport. The Democrats refused to do that, because County Executive Elect George Latimer was not in favor of leasing the airport, one of the ways Astorino wanted to balance the budget.

.

I was casually flicking up the labyrinth of the 2020 budget on the county website when my eye by serendipity what the anticipated the 2020 sales tax with a full year of the recent 1% increase and I saw the comparative figure for sales tax revenues with the 1% compared 2019 with just 6 months of 1%.

$740,718,401 Sales Tax Expected for 2020, compared to 2019’s $578,717,000

The sales tax increase in effect for a full year is not going to net out an additional $161,683,845 based on previous sales tax receipts over the years. Westchester would have to be packing the malls and restaurants to do that.

$161.7 million is the difference between projected 2019 sales tax receipts ($578 Million) at the current Westchester Economy’s pace and 2020 projected sales tax receipts at this time will hit $590 million, not $740 Million.

The October sales tax receipts are not in yet. They are usually furnished by the state on the 19th of each month. They are late.

The Westchester County 2020 budget is betting sales tax receipts will increase to $740 million.

That is optimistic.

The county sales tax handle increased 33% in1992; 12% in 2000; 16% IN 2004.

But, the 1% sales tax is not going TRIPLE tax receipts by itself.

The pace of purchases of sales taxable items has to pick up beyond belief to hit $740 Million in sales tax receipts in 2020.

Of course the Westchester economy could go through the roof. People could max out their credit cards; Amazon could move here; billionaires could snap up every million dollar home and furnish them; the minimum wage could go up to $20 an hour; car sales could double. The Democrats could win the election and every one would have one big party.

The county in their extensive explanation of the budget has not explained their rational for a 27.9% increase in sales tax receipts.

If the county got 1% more in sales taxes for the full year of 2019, the county will receive an additional $5,787,177

Add that to a full year of 2020 at 12 months of 1% increased sales tax that means you would only receive $11.6 Million in additional sales taxes, at the present rate of sales tax receipts growth.

That would mean the sales tax receipts would only hit approximately $591.6 Million ($580 Million plus $11.6 Million , not $740 Million)

A Possible Deficit of $150 Million?

This means the county is perhaps, knowingly creating a deficit of $150 Million dollars with this pie in the sky budget; MILLIONS more in possible deficit than the Astorino administration ever did in 2016 and 2017.