Hits: 508

WPCNR QUILL & EYESHADE. By John F. Bailey. July 17, 2019:

As reported on WPTV’s White Plains Week (www.whiteplainsweek.com), the announcement of the sharing of the 1% sales tax increase with towns was announced with great largesse by Westchester County to a gathering of county town and municipality leaders and school district leaders two weeks ago.

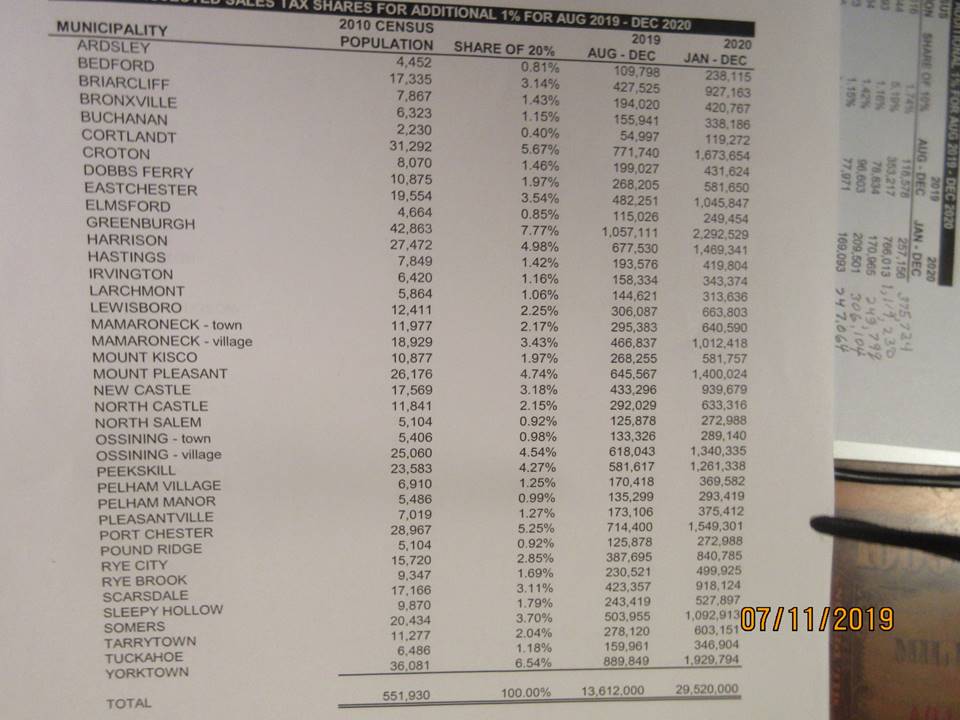

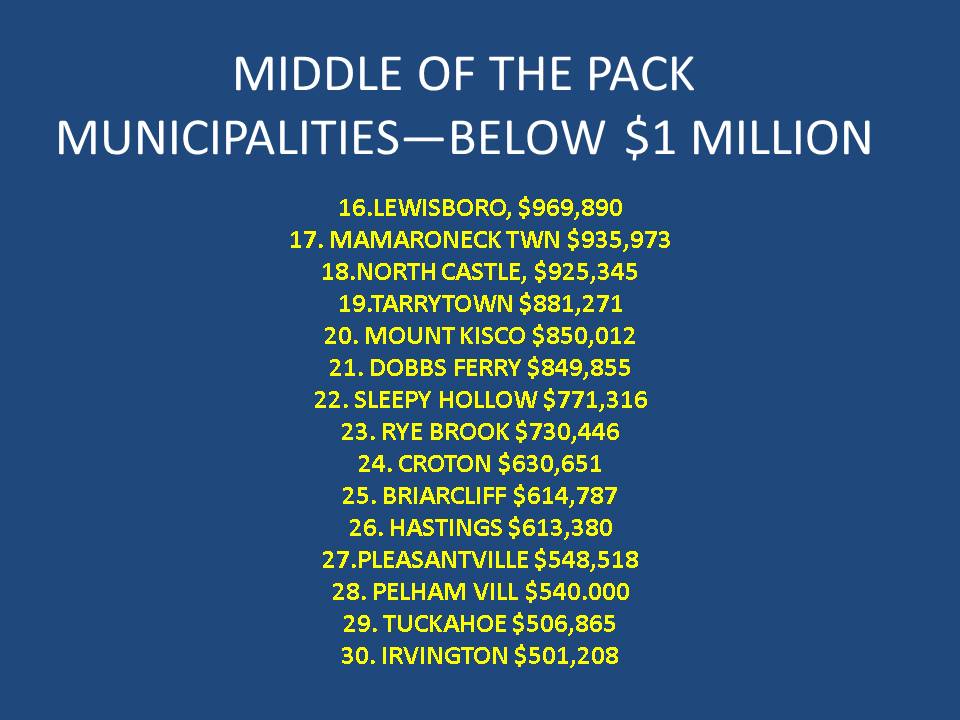

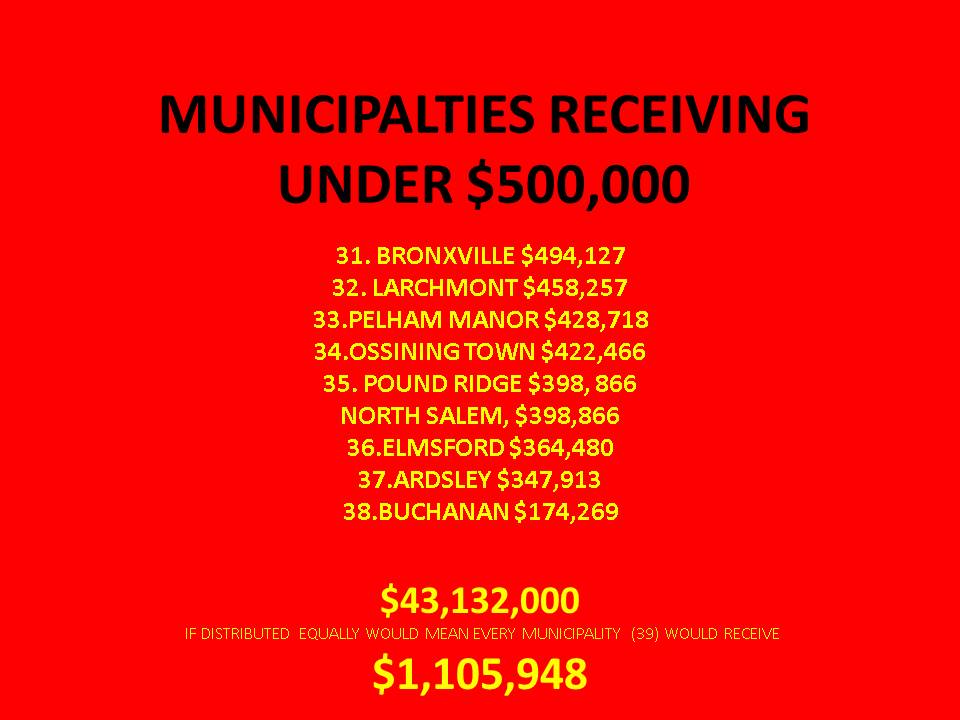

However, basing distribution on size of town creates an imbalance. Presently, unless the county changes its mind, 39 towns and municipalities will receive unequal shares of the windfall.

If 39 towns received an equal share over the next two years 2019 and 2020, of the county estimate of $$43,132,000, each town and municipality would receive $1,105,948. The combination of municipality share and school district share creates a cascade of cash the larger the town creating two-years of relief to the towns paying the new county sales tax rate.

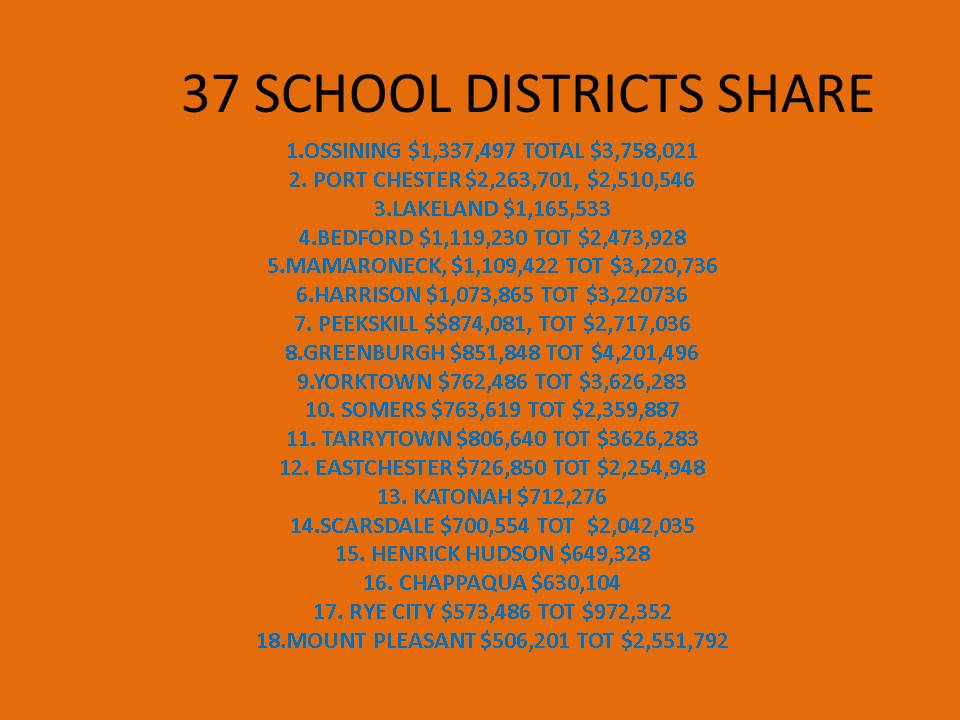

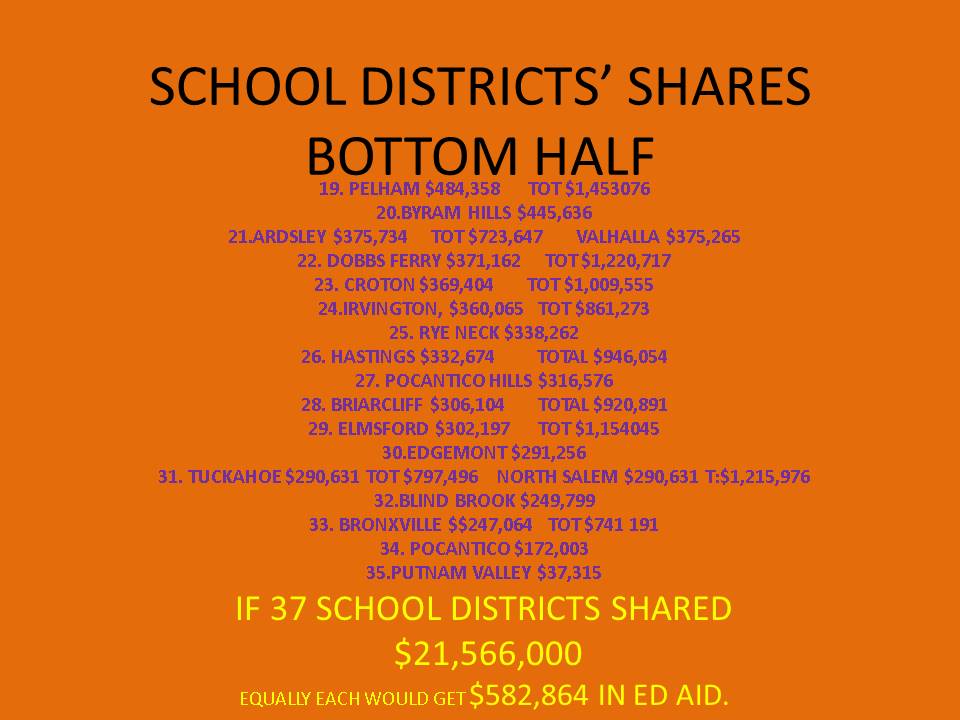

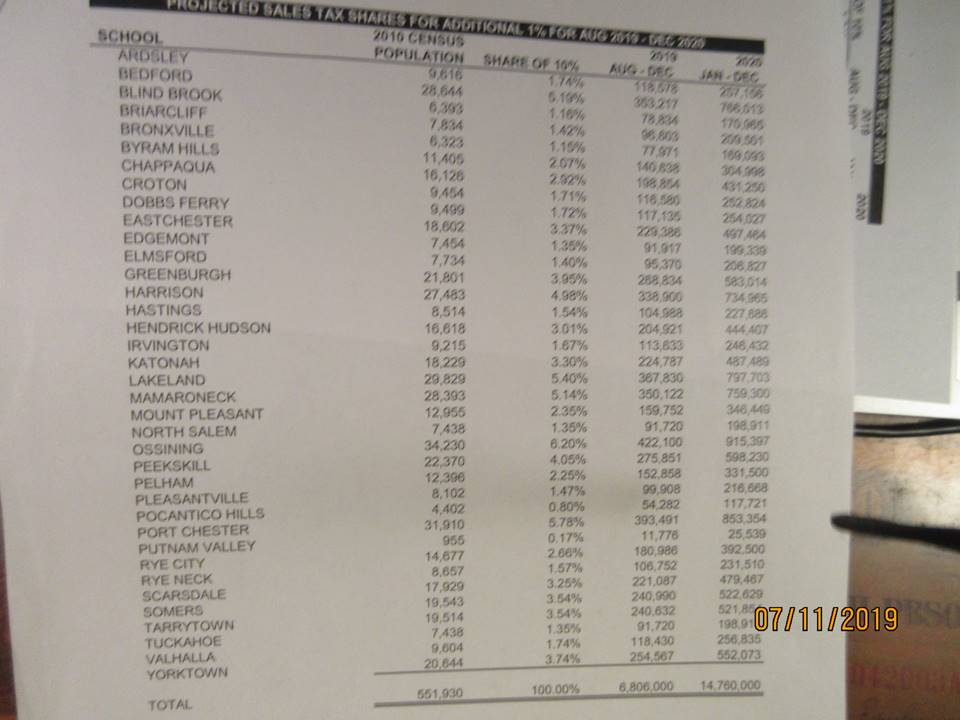

If 37 School Districts received an equal share of the county estimated share of sales taxes earmarked for school districts, $21,566,000, each school district would receive $582,864 in sales tax revenues.

However, county decided to distribute by population, which finds, in this reporter’s opinion, considerably more money going to towns and municipalities that are some of the wealthiest towns in the county. In the school districts, the mix is not so drastically different.

Here’s how population as the determinator of the distribution works out by population for the towns and cities:

Here’s how population as the evaluator of the distribution works for school districts.