Hits: 36

WPCNR QUILL & EYESHADE. By John F. Bailey. May 24, 2018 UPDATED WITH CHARTS 12:35 PM:

The economy is not recovering in White Plains New York USA.

It has been bleeding millions, beyond stagnant.

Unless the last two months of the current fiscal year, May and June have growth of 20% (which has never happened) the city will not meet the millions it earned last year in 2016-17.

It will not come close.

If we just meet last year’s May June numbers in sales taxes, the city will be down $3 Million in sales tax receipts, a decline of 11.5% in 4 years.

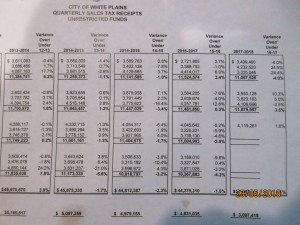

Four years ago in 2013-14, the city set an all-time record for sales tax receipts, $51,856,187.

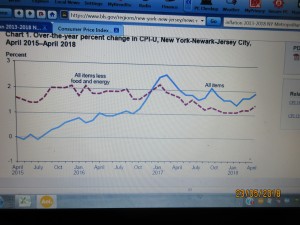

Inflation in years 2013 (1.7%), 2014 (1.3%),2015 (.13 %),2016(.41%) ,2017 (1.95%), and first 4 months of 2018 (1.68%), for the Metropolitan Area, would suggest the inflation rate averaged 1.36% a year.

Where’s the inflation?

If the White Plains economy were keeping pace with inflation, theoretically the sales tax results results should have risen 8.16% through April 2018. They have not.

As the chart of City Sales Tax Receipts in this year’s proposed city budget due to be approved next week, shows, the sales tax “handle” has declined to $49,310,345, through 2016-2017, a decline of 6.8% since 2013-14.

The sales tax receipts have declined every year since the 2013-14 high of $51,856,187.

(White Plains sales tax receipts are divided by the budget total, plus the amount taken from sales tax receipts to contribute to the Tax Stabilization Fund, used essentially to pay for salary increases in the budget to reduce the property taxes on citizens, so you add the “Tax Stabilization amount” to the Total Sales Tax Receipts column to get the total sales tax receipts for the year. For example, in 2013-14, you add the $46,670,570 Total to the Tax Stabilization Fund $5,185,617, to come up with the $51,856,187 Total to get the high water sales tax revenue in 2012-14)

With two months to go in this closing fiscal year 2017-18,, unless we have better than last year’s May-June activity in sales tax receipts which was $7,998,748 combined, the sales tax will decline to $46.2 Million– if we can equal last year’s May June Numbers, $7,198,873 combined receipts, the city will be down $3 Million in sales taxes.

The March April Numbers showed life. The city March sales tax receipts of $4,013,136 as reported by the State Department of Taxation and Finance, were 3.4% less that the March 2017 receipts of $4,154,589.

The April Sales Tax Receipts were good, increasing to $3,756,339 compared to the April 2017 $3,521,122, a growth of 6.7%.

The trend is not good. The Budget and Management Committee, the finance department, the Common Council has to wake up and smell the coffee.

55 Main Street. You and we the residents have a problem.

The millennials cannot come in here fast enough.

The city has to reinvent its image by making White Plains more friendly and diverse in establishments, retail, restaurant, and entertainment.

Raising sales tax again to recapture this lost revenue will simply aggravate the problem.

Raising Parking rates and Parking ticket fines will not do it. That will perpetuate the perception that White Plains is not a friendly, convenient place to visit, that it is ticket-revenue happy.

White Plains is a safe, interesting city, with the lowest property taxes in the county, I believe, but its planned development is not proceeding fast-enough.

The failure of timely construction of approved projects due to failure to find ready financing of the projects due to reluctant retail tenants wary of betting on millennial money, is one of the many factors that have put White Plains development off schedule.

The $3 Million decline in sales taxes, unless a sales tax miracle occurs and we get a 30% increase in economic activity in the city in the two months we will not come close to equaling this sales tax revenue deficit.

Next budget year, 2019-20, is when this economic depression is going to hit hard.

A city property tax increase of at least 6% to make a correction in the (at this time)$3 Million revenue shortfall in the sales tax, could be considered and with an eye to funding the next round of city labor contracts and benefits negotiations, currently $124,738,322. ,up 2% in the 2018-19 proposed budget.

This year’s budget coming up for approval next week the proposed budget has a 2.9% increase in the property tax resulting in a $59.8 Million property taxes on a $211.36/$1,000 of assessed valutation.

If the $3 Million deficit in the sales tax becomes reality, the $3 million could be made up by adjusting the 2019-20 budget a year from now by a $230/$1,000 of assessed valuation, a $20 increase in the property tax rate tax would stop the bleeding from the sales tax revenues of 2017-18 and cover it for the next year, if the disturbing trend continues, (while waiting for the new development bonanza to get going).

That much of an tax rate increase, is comparable to the $18 per thousand in assessed valuation the school district raised the school tax rate in their recently approved (by 82%) 2018-19 school budget.

Now, the Common Council has the ability to submit a budget next year that exceeds the Governor Cuomo tax cap and straightforwardly next year make up that sales tax shortfall with a $20 increase in the tax rate to $230/$1,000.00; the city government budget is not subject to a referendum approval of their budget by the voters.

Other things they could do is raise city fees to make up the $3 Million decline in the sales tax receipts, should that decline not turn around. But the city will not know that until a year from now.

They could take $3 Million from the $35 Million Fund Balance the city has, and cross their fingers.

The sad truth is the Budget and Management Committee, the finance department, and above all the Common Council should have been more concerned about this sales tax erosion, which is really hurting this year.

It will be hard to reverse and won’t start to reverse until the millennials come to the rescue maybe (please come into town now) which is years away due to financial problems on part of developers of already approved construction projects. Just one has been built and that is The Continuum.