Hits: 0

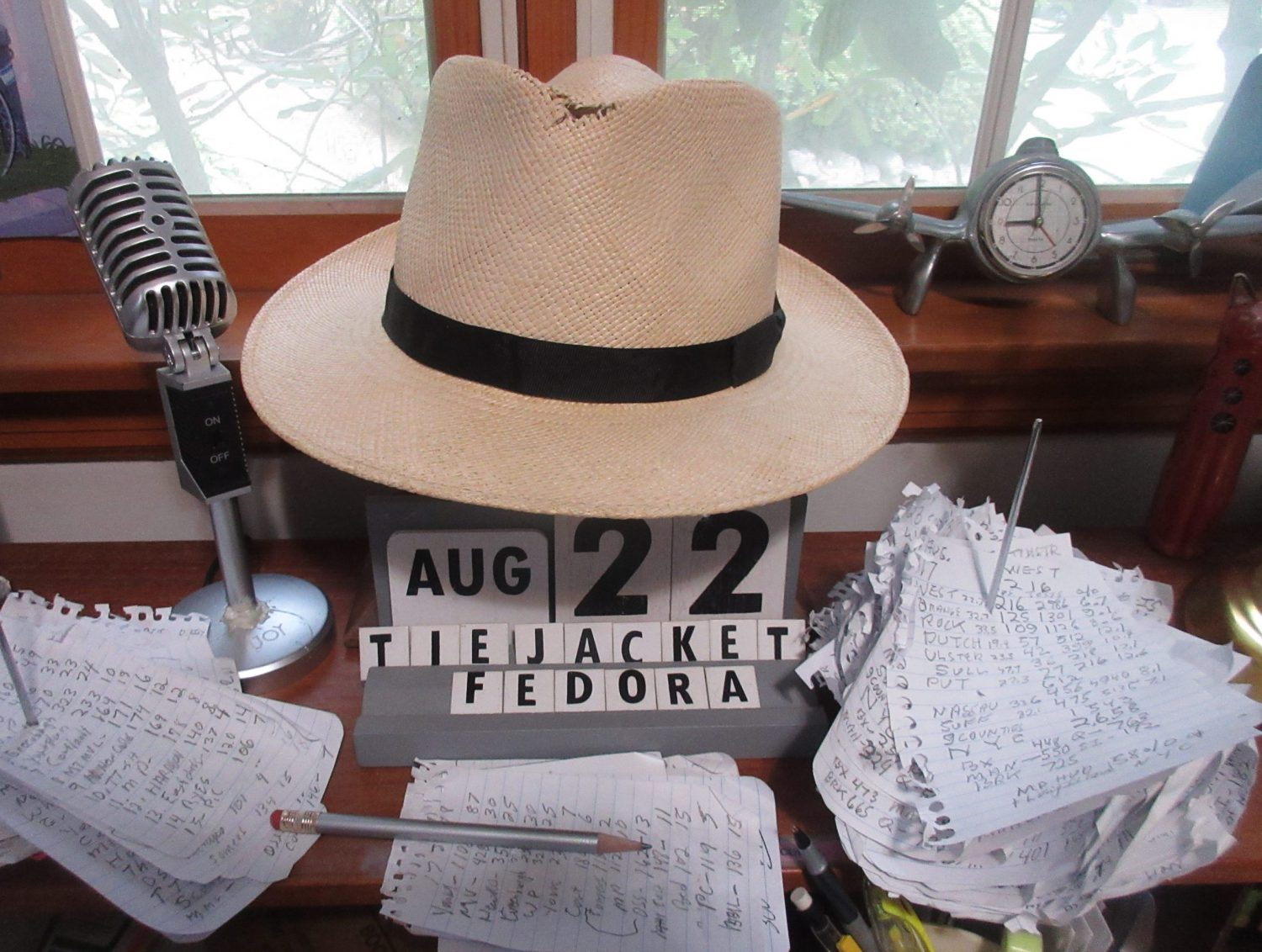

WPCNR Quill & Eyeshade. By John F. Bailey.

Looking at a decade of School District Budgets and Tax Rates shows the erosion of the tax base in combination with a policy of retaining the district current rate of spending no matter what, and a city policy of sharply increasing spending is sideswiping the city taxpayers from opposite directions and leaving them for roadkill.

Crunching the numbers from Monday evening’s Board of Education discussion of the effects of the 2006-2007 tax roll shows, and the subsequent introduction of a plan to tax variable PILOT properties at the new $449.64 tax rate, ignores the obvious message that the School District is flat-out raising the school tax $11 million to maintain the current level of spending on the schools.

The 9.54% tax increase sent up last night follows on the heels of the 9.36% increase passed last year..

In the years going back from 2006-2007 to 1995-1996, the increases in the tax rate per $1,000 have been,

2006-2007 (Proposed): 9.54%,

2005-2006 9.36%,

2004-2005 7.53%

2003-2004 6.89%

2002-2003: 8.59%

2001-2002: 7.94%

2000-2001: 7.64%

1999-2000: 6.72%

1998-1999: 5.51%

1997-1998: 4.94%

1996-1997: 7.94%

1995-1996 9.33%

The school budget has grown from $89.4 Million in 1995-96 to $166.1 Million, an increase of 86% in a decade when inflation has risen 26%. The very size of the school budget and the inevitable “compounding” effect make the budget apparently impossible to harness and rein in, compounding at more than three times the inflation rate.

The 86% increase in school district spending has translated into a 92% increase in the tax rate from $202.91 per $1,000 in assessed valuation in 1995-1996 to proposed $449.64 per $1,000 tentatively announced Monday evening.

The tax rate has more than doubled, the $449.64/1,000 announced Monday is $247 over the $202/$1,000 in 1995, which translates to a 122% increase in the tax rate, against a 26% rise in prices since 1995.

City Tax Roll in Freefall.

Down $23 Million in Three Years.

The city announced to the school district last week that the City Tax Roll had declined to $298,326,000 for 2006-2007, from $304,681,000 in 2005-06. It was down for the fourth consecutive year. (WPCNR has rounded the numbers)

In the last four years the Tax Roll has declined $22,472,507. ($4.4 Million in 2003-2004, 9.1 Million in 2004-2005, $2.6 Million in 2005-2006, and this year, $6.3 Million).

The $2.6 billion of development is not working the way the city envisioned it to work for the city, but it’s working out very nicely for “the developers.”

Developments Cash Contributions Lag Behind

Certiorari TakeBacks.

Even when counting sales tax ( an estimated $9 Million a year gain from the new development) and with PILOTS bringing in $8.8 Million the new development could be considered to be contributing about $18 Million a year to the city – but the decline in assessment is a net loss of $4 million to the city. This is not a dollar for dollar loss, but when you take into account that revenues are built on the assessments, not the developer’s cash – it is sobering to ask why isn’t the development working because it is not.

We are told it is early yet, give it time. The condominiums will start paying taxes, but not at the same rate as homeowners do. We shall see.

The new development contributions have not kept pace with the assessment apocalypse brought about by commercial property owners winning massive certiorari and resulting assessment reductions from the city. When commercial owners getting breaks go for certioraris, that ultimately transfers the tax burden directly to Mr. and Mrs. & Ms. White Plains.

You, Mr. and Mrs. and Ms. White Plains are paying their taxes.

When the net value of

Anatomy of the 9.54% tax rate hike.

Let us take a look at the indifferent inexorable assessment apocalypse and its effect on the 2006-2007 school budget that has increased rather a modest 7.4% from 154.7 Million to $166.1 Million.

Using rounded figures here, when the tax roll dropped last week to $298,326,000, that took $6,354,000 away from the roll. The former assessment, $304,680,000 had produced $125 Million in tax revenue in the 2005-2006 budget.

The reduction in the assessment meant the lower tax roll of $298.3 Million would produce $2,608,000 less revenue at the old $410 tax rate creating a total tax revenue of $122,448,000, based on the $410.45 per $1,000 Tax Rate of 2005-2006.

However, the school district increased the budget $11 Million to retain this year’s level of education services. There was not enough jing in the old tax rate of $410.45 to deliver the $11 Million when the new Tax Roll total was learned.

In order to balance the budget without cutting it, the district needed $13,000,000 in tax levy to move the levy from the $122.4 million resulting from the loss of revenue from the decreased assessment.

The school budget first had to raise the tax rate to replace the revenue lost by the lowered tax roll, by increasing the tax rate $8.75 per $1,000 to make up the $2.6 million lost to the $6.3 million decline in total tax roll. That brought the tax rate up to $419.19 per $1,000 of assessed valuation.

Having increased the Tax Rate from $410.45 to $419 and some change per thousand ther district had to replace the shortfall brought about by the $6.3 million drop in the tax roll.

Now the district was at last year’s level of revenue with the added $2.6 Million bringing you to $125 Million. But to get to the $11 million to make your $166.1 Million budget, you’re short.

Enter the PILOTS

Ahhh, but here come those wonderful PILOTS. You can plug in a windfall of $1.6 million increase in PILOTS, enhanced by Mr. Schruers Levy 1 Plan introduced Monday evening whereby the variable PILOTS are taxed at the new tax rate (which we shall arrive at in a moment, Quill and Eyeshade aficionados).

Subtract the $1.6 Million in PILOTS from the $11 million gap and you reduce your shortfall to $9.4 Million.

Divide the $9.4 Million by 298,326 (298,326 is the new tax roll multiplier), and you come up with 31.5 cents, which is what you have to add to the tax rate of $419 to get your new tax rate of $450 per $1,000 of accessed valuation.

I have used round figures here to make this less tedious to read. The School Budget figure comes to $449.64, but that is how the figure is arrived at.

What this tells us is that when assessments go down it hurts. PILOTS hurt because they take property off the tax rolls. PILOTS contribute a mere $8.8 Million to the budget as of Monday night.

That $8.8 Million is, Mr. and Mrs. And Ms. White Plains 5% of the School Budget. Is the developing helping the city? It is helping the City of

State Senate Roadblock to Relief.

As mentioned before it is the city’s casual attitude toward certiorari filings the last five years that appears to have encouraged many big time players in the city to file for certs while enjoying city tax breaks. Those certs have devastated the tax roll. Ripped it apart.

Assemblyman Adam Bradley and State Senator Nick Spano are introducing a bill to create two separate equalization rates for commercial and residential properties for

State Senate Indifference.

Bradley told WPCNR Saturday, reacting to the assessment “The bill I put in would have a positive impact for residential homeowners throughout the county, and a place like White Plains where there has been tremendous reduction in commercial property value through tax certs, where they (commercial property owners) wind up getting substantial benefit, as a result, the burden then falls more onresidential property owners.”

“Last year it ended up dying on the floor of the senate, when I was told the Senate would not be able to pass it. The bill is currently in (the Assembly) Real Property Tax Committee, chaired by Sandy Galef, and I expect it’s something we can move out of that committee, and probably pass. I’m waiting to get some feed back from local assessors on some changes to it, but as a concept in the bill, as it is currently structured, it would be of tremendous help (to homeowners).”

Asked if it would still limit the amount of certiorari any commercial property could receive, Bradley said it would either do that, “or we’re going to have a separate commercial assessment rate, either one of the two, we’re still grappling with this. The current bill is an attempt to create a more level field right now. The problem is primarily in

WPCNR asked how the bill in committee would fix this. Bradley said “It would create a separate commercial rate for tax certs, therefore it would automatically help, because they would not get the benefit of the unified rate.”

Asked how this bill differs from the one rejected by the senate for two years, Bradley said, “Every year is a new year I can’t speak for the Senate. I know Nick Spano is introducing the legislation in the senate and we’ll see. Currently the bill is identical. It may stay identical, I’m waiting to hear back from a few other assessors. My feeling is right now it is the same.”

State Senator Nick Spano has not responded to WPCNR with his comments on how the separate equalization rate bill might fare in the Senate this year.