Hits: 48

WPCNR QUILL & EYESHADE. By John F. Bailey. April 9, 2018:

As the WPCNR battery of tax accountants, consultants, financial advisors and legal advisors debated tax strategies prior to filing the WPCNR massive tax return next week, the numbers for the extensive WPCNR properties do not look too intimidating at least for 2018-19.

My tax strategists advise the way the White Plains City Government and the City School District have set up their preliminary budgets for 2018-19 deliver a sustainable pace.

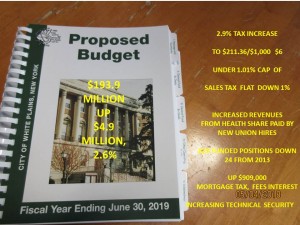

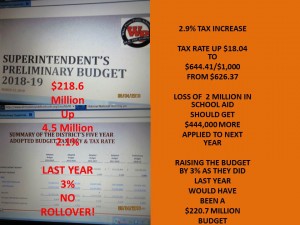

The city is raising property taxes 2.9% and the School District is raising them 2.9%. Both property tax increases are under the tax caps (1% for the city and 2% for the school district).

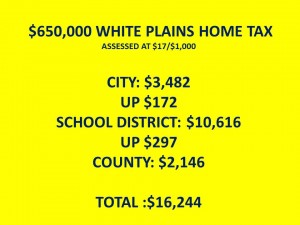

The City increase ups the tax on a White Plains median priced home of $650,000 assessed at $16.475/$1,000 of assessed value, $172 to $3,482.

The School District total property tax on that $650,000 home goes up $297 to $10,616.

Add the 2018 County Property Tax for White Plains,(including sewer and garbage) of $2,146.

The median home of $650,000 will pay $16,244 in property taxes in 2018-19.

The school district did the residents of White Plains a big service by cutting the rate they raised the budget. Last year the district raised the budget 3%. This year they raised it 2.1% to a total preliminary budget of $218.6 Million. Had they increased it 3% as they did last year, the 2018-19 School Budget would have topped $220 Million ($220.7 Million).

However, depending on how Governor Andrew Cuomo’s plan to shield the property tax deduction from being limited by President Trump’s new tax law, fairs in the courts, you most likely will pay more federal taxes on your 2018 return than you do this year due to loss of deductibility of state and local property taxes. Take that $16,244 projected property tax increase for example. Withdeductibility limited to $10,000 in the new tax bill, that decreases the income deduction by $6,000. If you do not allow for that by increasing your withholding now, you will be scrounging to come up a tax payment. Of course if you’re assessed at more than $17/$1,000 of assessed value the stakes are much higher.

The Trump tax law now in effect is touted as a tax cut for all. It’s not. It is a massive tax increase on every one who owns a home and is subject to a state income tax.

Looking at the 2019 Westchester County Tax outlook is not positive.

Pressure on the school district and the city will increase next in 2019, to cut spending more when the outcry from the White Plains middle and upper class homeowners see what the Trump Tax Law does to them if they had not planned for the impact.

With the $15 Million surplus in sales collections achieved in 2018, the deficit decried by the County Legislature which prompted the Astorino Airport lease deal has been taken care of with that surplus, if they wanted to use the surplus for that purpose.

The County Board of Legislators which passed all the Astorino administration budgets except the 2018 one, and raised that slightly, is now singing a song of deficit spending about the past eight years.

County Executive George Latimer is having the state comptroller’s office audit the county budgets. That report is supposed to be in by the end of the year just about budget time.

Perhaps the County Board of Legislators should have paid more attention to Astorino spending the last eight years, after all, they passed his budgets. The County property tax if it raised in White Plains say 10% would go up $214. If it went up 20% it would go up $429—not appreciably egregious.

If the comptroller finds the Astorino administration was able in the comptroller’s office opinion to hold the line on taxes by creating deficits and unfunded mandates or God knows what, at the expense of services, this could be a license to spend for the County Board of Legislators to “put the county on a prudent financial footing, deliver services badly underfunded.”

If you go by the rationale that county spending should have been increased 3% a year for 7 years, that is a 21% increased one time in the county budget to “put the county on a sound financial footing.”

You have to ask yourself who was looking at the county budget the first seven years of the Astorino administration. The answer is the County Board of Legislators.

Does 21% one-time increase in your lowest tax, the county property tax sound right to you?